Donate to Hillary Outdoors

Thank you to our incredible community of Donors, Trusts, Partners and Supporters who join us on our mission to ensure all youth, no matter their finances or abilities, have the opportunity to enhance their lives through outdoor education. It’s with the help from amazing people, like you, that we will overcome financial inequities and immerse rangatahi in a safe and inclusive environment that fosters personal growth and wellbeing; providing them with the opportunity to succeed.

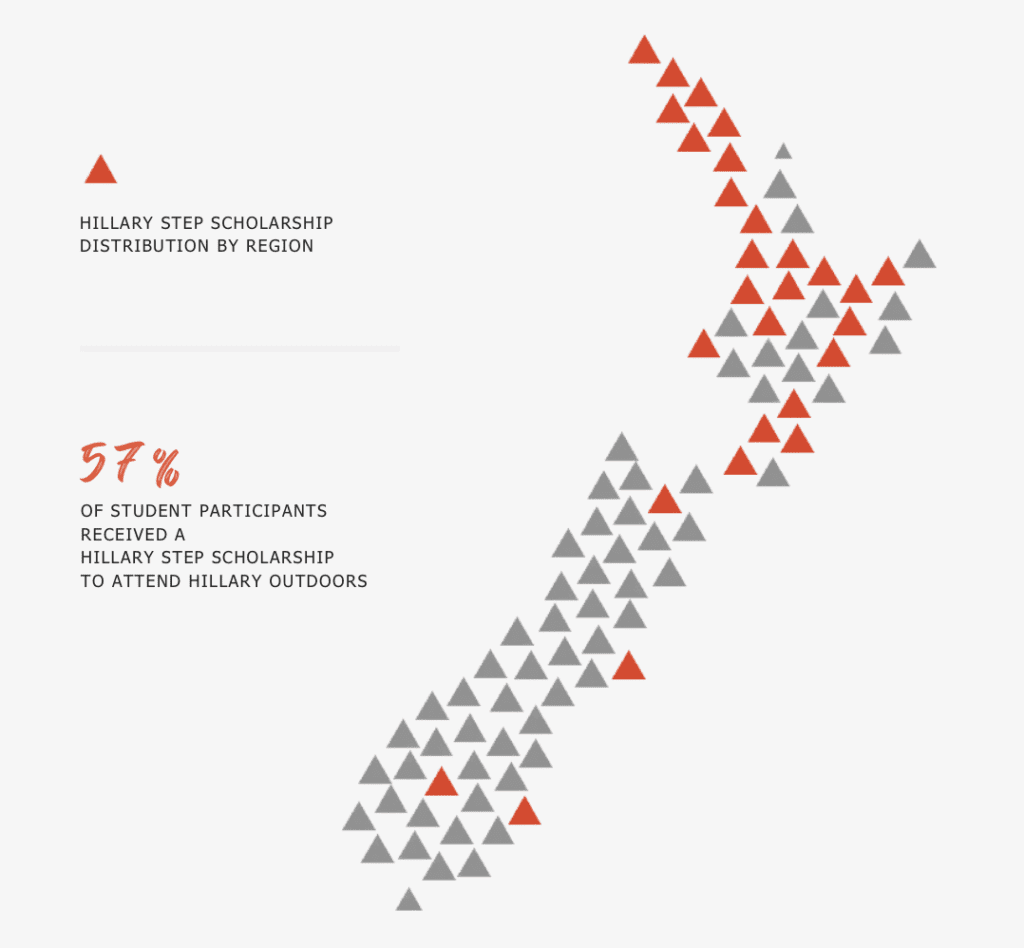

Each year, through our Hillary Step Scholarship programme, we strive to raise $1 million to help young people from across Aotearoa realise their potential and change their lives through adventure.

Last year we raised close to $700,000, supporting over 5,500 rangatahi to have transformative experiences that develop their resilience, confidence and leadership.

With your help, we will create brighter futures for rangatahi by empowering them to do extraordinary things!